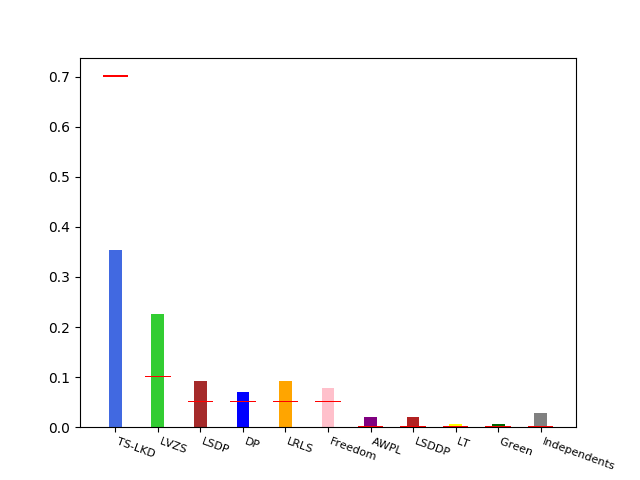

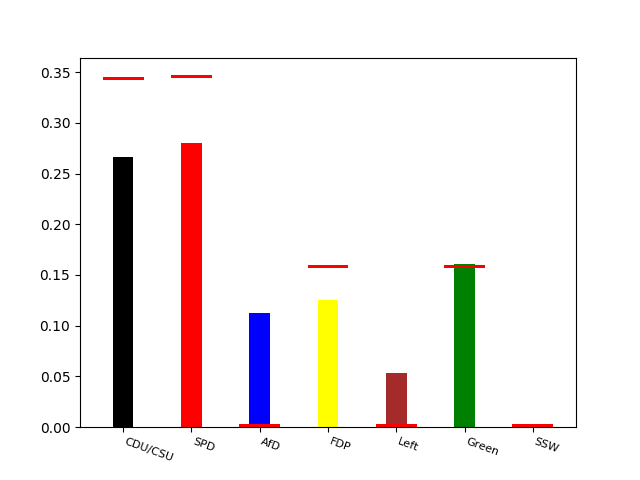

The Social Democratic Party of Germany (SPD) demonstrated the highest rate of support among German voters (25.7%) during the federal elections on September 26th. The CDU/CSU block is following closely (24.1%) but was unable to secure a leading position due to its change in leadership, as well as criticism of some recent policies.

These results make a coalition government necessary. As the Left received lower electoral support (4.9%) than predicted by pre-election polls, the coalition of SPD, Left, and the Greens cannot secure a majority in parliament, thus narrowing down the range of possible outcomes of coalition formation.

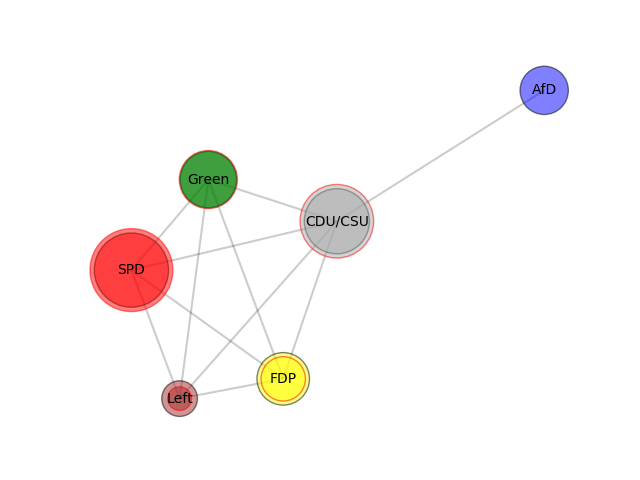

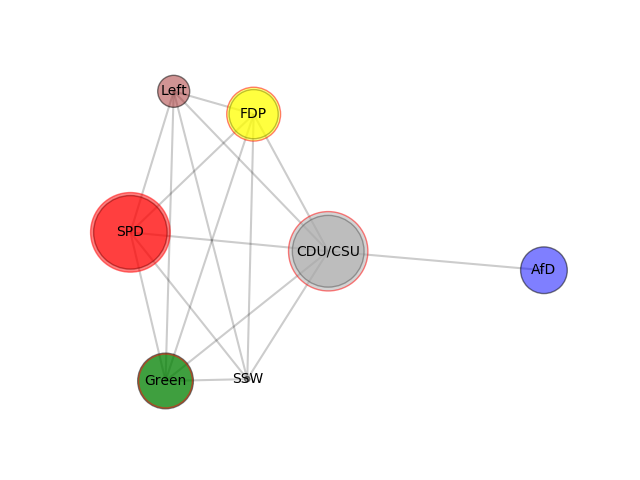

We apply an original methodology, Gamson-Shapley Laws, to construct the following prediction. We base our forecast on the election results, and assess the stability of alternative majority coalitions subject to compatibility constraints among their members. Specifically, we assume that no party besides the CDU/CSU would partner with the right-wing Alternative for Germany (AfD). By contrast, we do not strictly exclude the possibility of a CDU/CSU-SPD coalition but consider it a less likely scenario, as these parties have indicated that they would not favor a so-called “grand coalition”.

We use data from the Manifesto project to calculate the distance between policy positions of the political parties, even though these historical data, given the recent changes in leadership of the Union, do not fully reflect current policy positions.

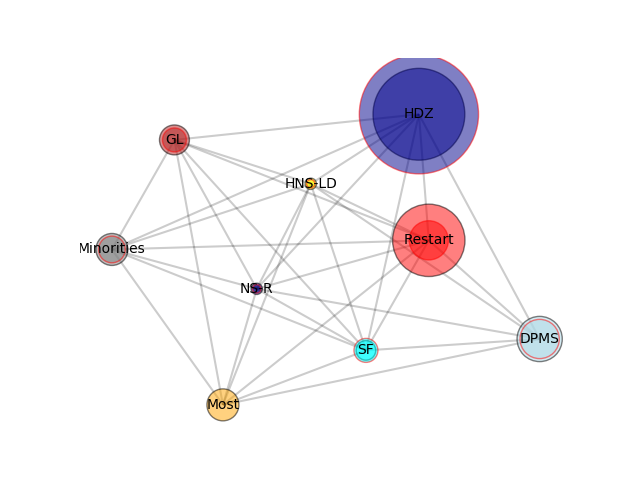

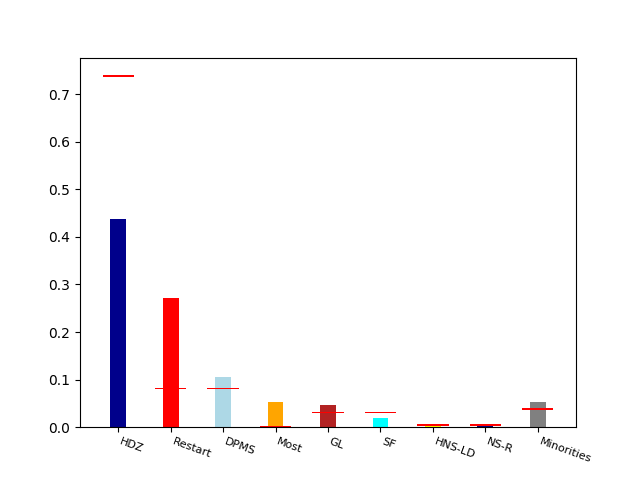

For each party we calculate its strategic influence (a measure of the impact the party could have on different coalitions towards reaching a majority), and rank each majority coalition by stability (a measure of the overall motivation of its members to participate).

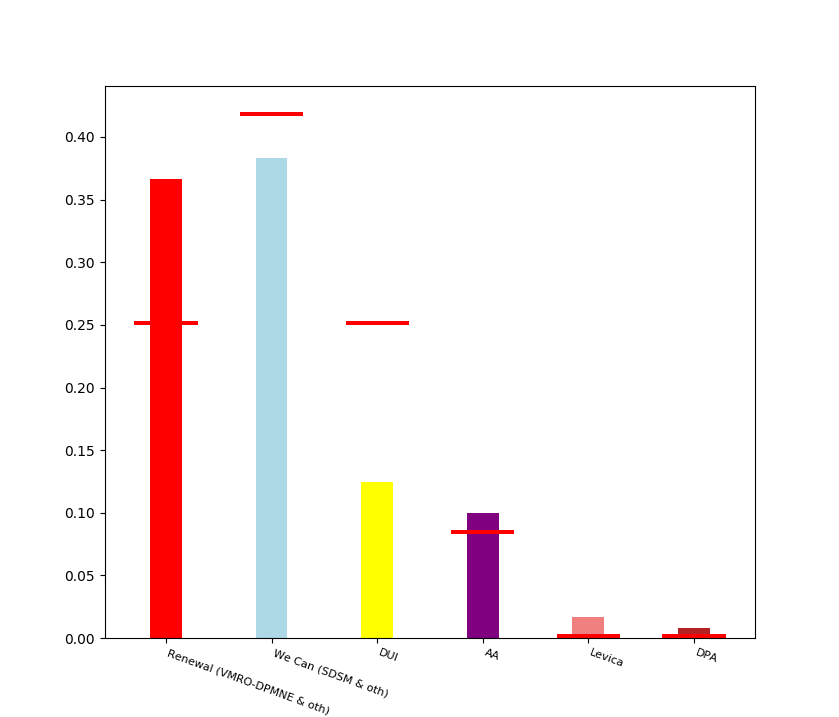

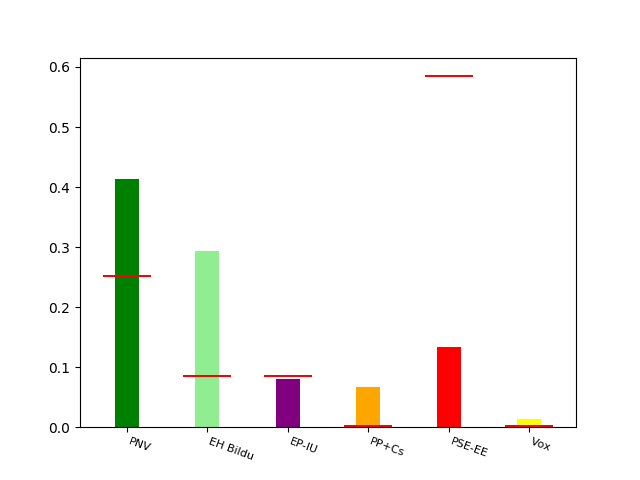

Projected seats (bar size) vs. strategic influence (Shapley value) of political parties (red lines)

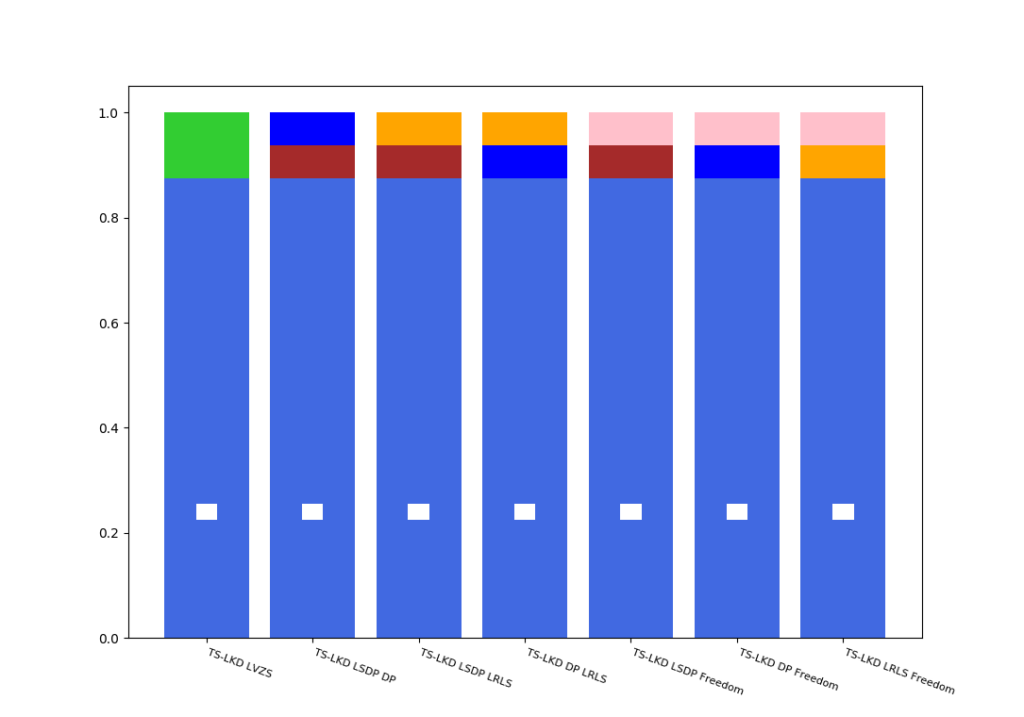

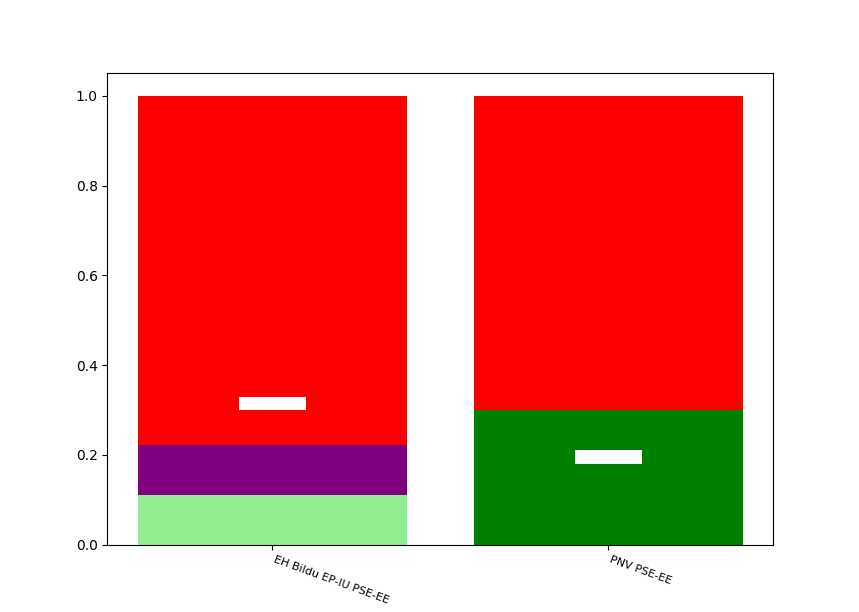

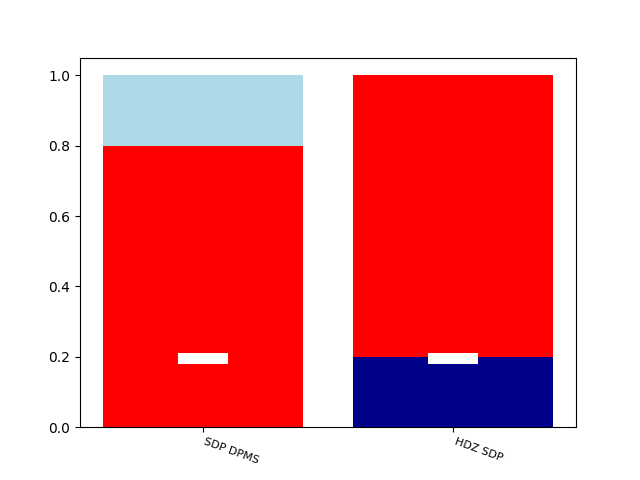

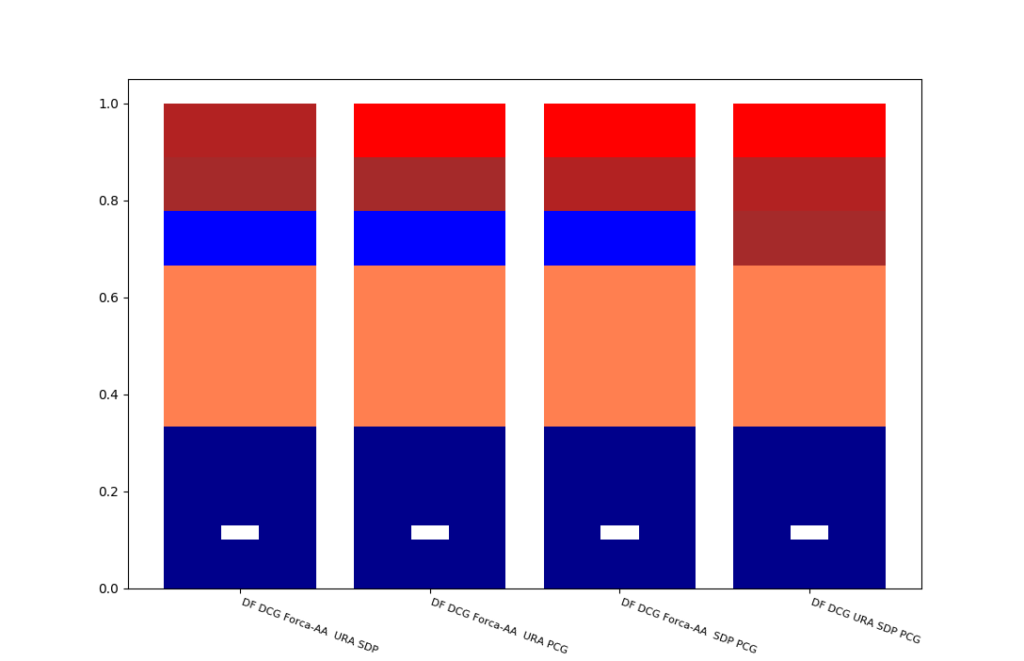

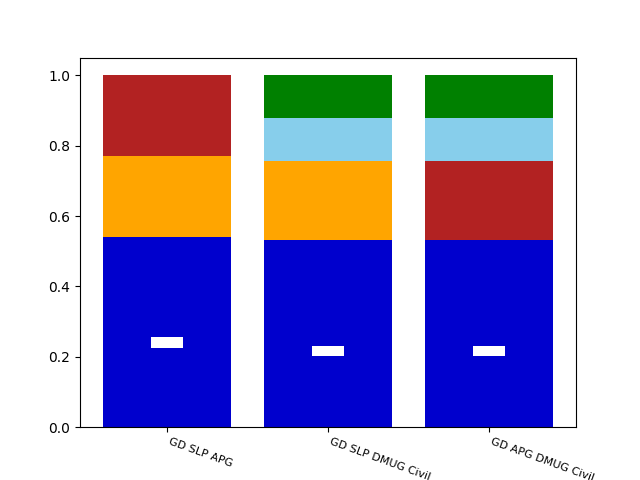

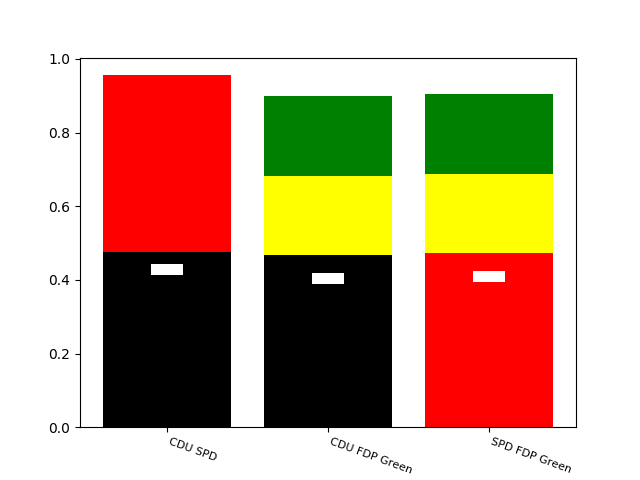

Stability (white bars) of predicted majority coalitions

Given that the CDU/CSU-SPD coalition (highest stability) is not likely to emerge by the intentions of their leaders, FDP and the Greens find themselves in the position of king-makers: the CDU/CSU or the SPD can only form separate majority coalitions in case FDP and the Greens also join as junior partners. The ‘streetlight’ coalition ( SPD-FDP-Green) has a slightly greater stability due to a higher closeness of the platforms of these political parties.

The CDU/CSU-SPD, while less likely, cannot be totally ruled out in case a tri-party agreement cannot be reached.